I don’t like to project the same bias from week to week, which is why I’m constantly dipping into the spring of analysis and ideas out there in the financial universe. When the data changes, we must move with it.

And as you know, the purpose of this newsletter is not just to take a glance at the headlines, but to dive a little deeper below the surface and uncover the real trends. This helps us understand the road ahead and formulate a more strategic approach to investing and trading.

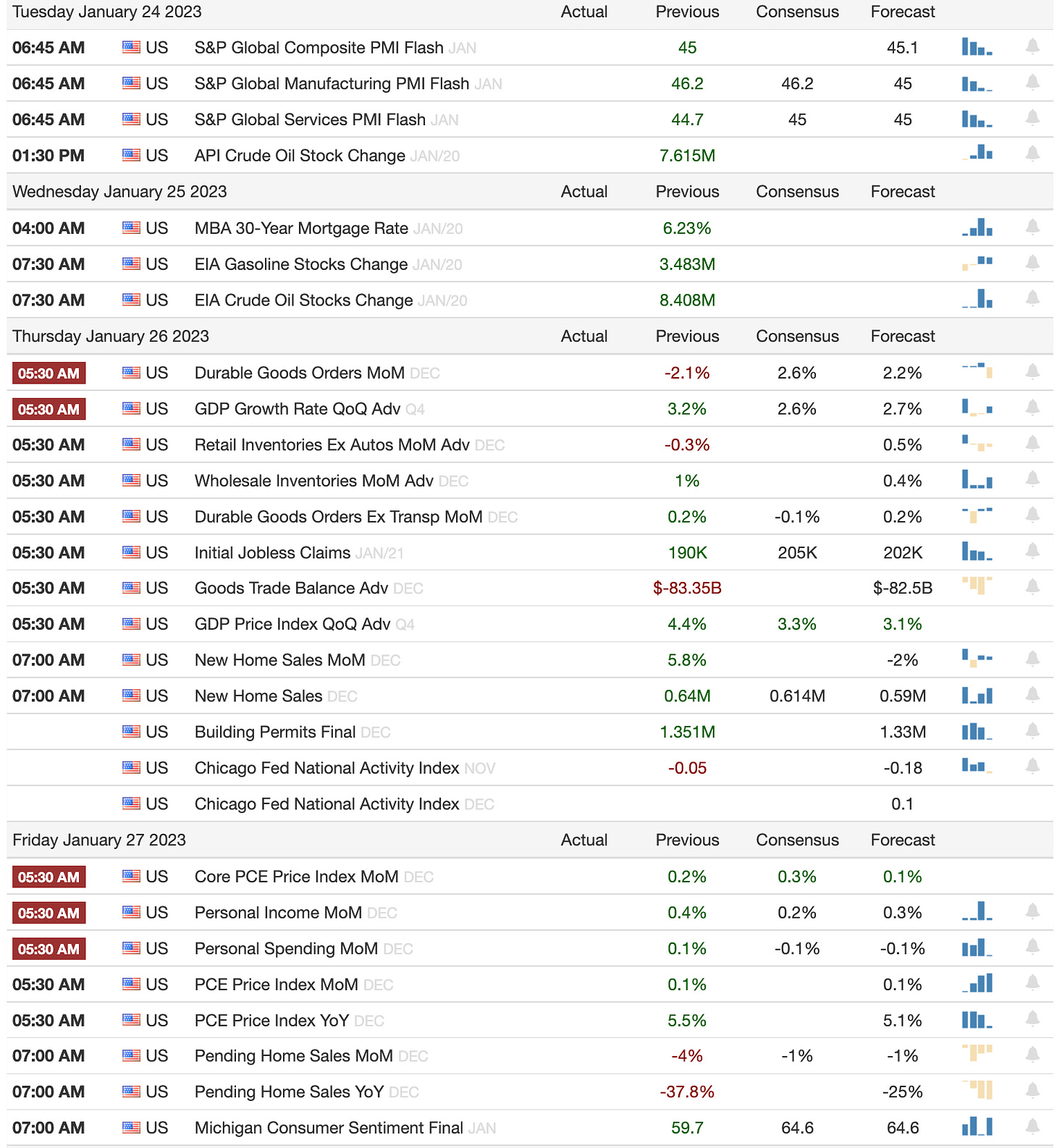

Jan 23-27 Economic Calendar

Highlights:

Manufacturing & Services PMI - Tuesday, Jan 24

Q4 advance GDP estimate & Durable Goods - Thursday, Jan 26

Core PCE, Personal Income, Consumer Sentiment - Friday, Jan 27

A core PCE print at or below consensus of +0.3% MoM for December should satisfy investors, but an upside surprise could erase some of the recent advances. Use appropriate risk management ahead of Friday’s report.

In a recent survey, investors estimated only 50 bps total hikes left before the Federal Reserve enters a lengthy pause. As time goes on however, the expected length of that pause is shortening.

According to FedWatch, there’s now a higher likelihood that rates will begin to come down before the end of 2023. In my view, the market is probably right. Beware though, because Fed officials will continue to talk tough for some time.

But we’re beginning to see the cracks already. On Friday we talked about the Retail Sales Surprise and how the market reacted. I swear it’s been a while since we’ve seen a wholesale swoon at that kind of data…a really long while.

Something feels like it’s shifting. We’re exiting the era of bad news = good news imo. Expect stocks and crypto to fly when there’s positive indications of a soft landing, and to drop whenever the data shows sticky inflation or a tighter-than-expected labour market. The inversion is starting to rebalance.

Quick Takes

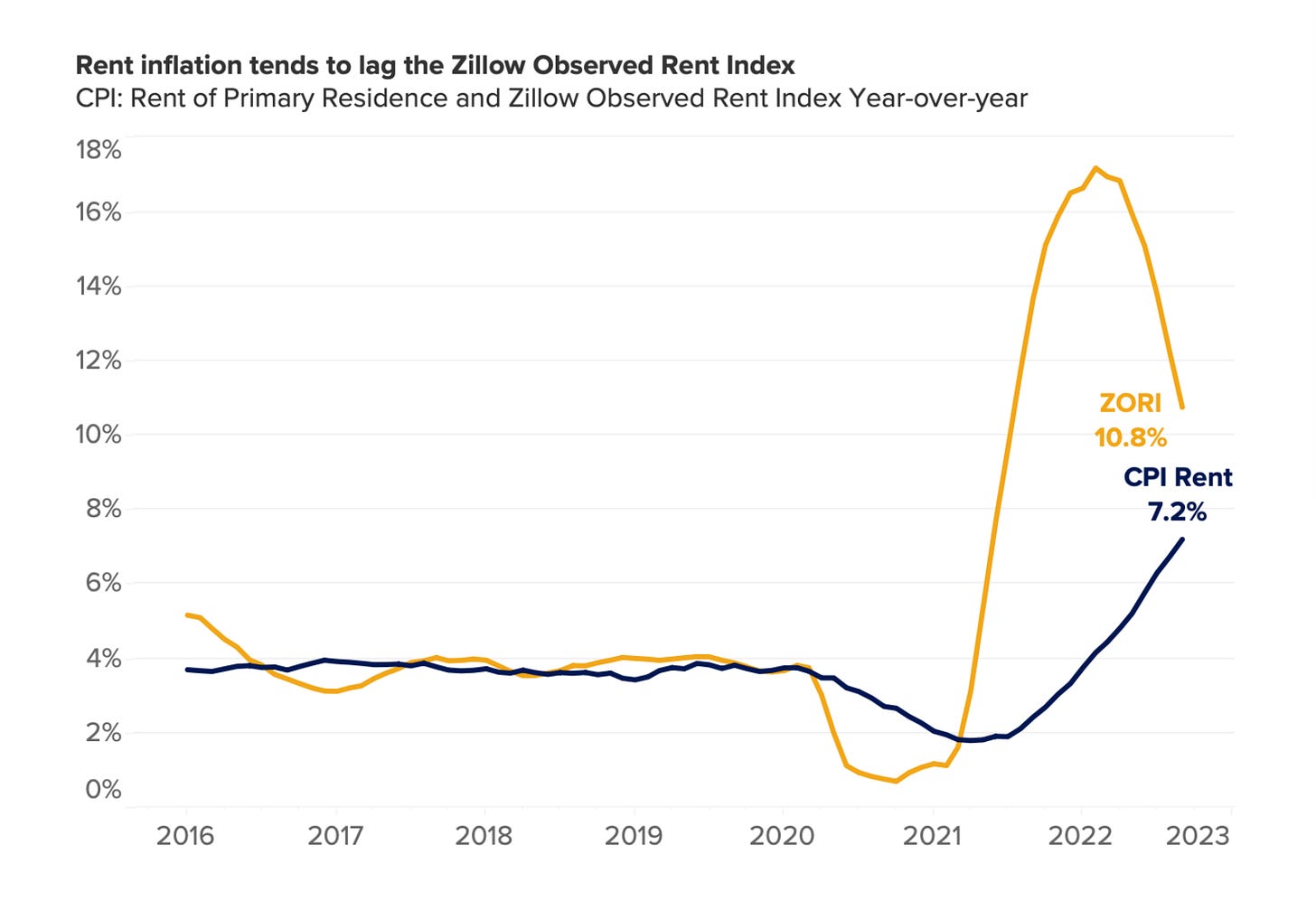

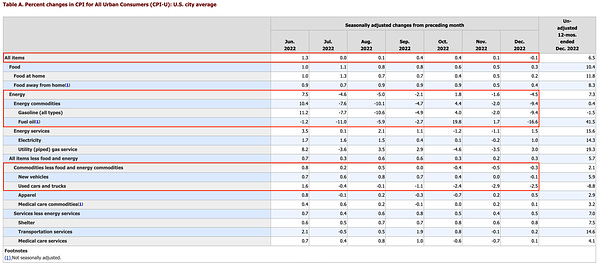

Fuel and used vehicle prices have come down significantly, but rent remains a major problem.

But there’s a light on the horizon…

The SF Fed researchers find the strongest correlation between CPI rent and ZORI at a 12-month lag, so February 2023 is a natural candidate for the most likely turning point in CPI rent inflation.

- Zillow

A distinct lag exists in the magnitude of rent inflation as measured by the CPI and private sector measures of asking rents, such as ZORI. This is due to the nature of data collection as well as the survey frequency.

The ZORI data shows a declining trend since the start of 2022, and that’s great news.

There is indeed a light at the end of the tunnel and we will come to find out how close we are to the end of it in the next 2-3 months.

Jan 23-27 Earnings

It’s a huge week for earnings, with Verizon, Microsoft, Tesla, Boeing, and Intel. We also have several airlines and credit card companies reporting.

We know that the tech companies have been enforcing layoffs recently. Will that be enough to clean up the balance sheets? Stay tuned.

There’s a lot of data coming out this week. Instead of making predictions, I’ll come back with my thoughts and observations after the fact. Enjoy the show!

Jay Charles

Editor in Chief, The Trading Tank.

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author.

The Trading Tank is a publisher of financial information and not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY OR PUBLICLY TRADED ASSET DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.