Bitcoin Seasonality

While ruminating over the current market state, I remembered my old friends news cycle and seasonality. Last week I cautioned people not to get levered up yet, because this thing could go lower. But just today Germany concluded the sale of their $3B in Bitcoin and the price hasn’t made a new low. Then we’ve got Trump making headlines and appearing at one of the biggest crypto events of the year in Nashville on the 27th. This should garner huge media attention. Additionally we have the incoming Ethereum ETF and a new application from VanEck for a spot Solana ETF just this week. As Joe Biden falters in the polls, Donald Trump and his crypto-favourable campaign are surging. Things just might be getting close to turning a corner. In case you need more, here’s a tweet I posted yesterday:

Market Overview

Weekly performance:

$BTC +3.5%

SPX +0.76%

NQ -0.27%

DJI +1.45%

Crypto Sentiment Check

A majority of assets remain below key moving averages. Alongside that, the crypto Fear & Greed Index slid to new lows for the year and now sits at 25! We’ve official hit ‘extreme fear’ stage. Again this does not signal a bottom, but can hint at a turn possibly coming soon.

Top Trades

On Monday we bought the dip in $POPCAT and caught a +25% move. The market was notably slow this week, so our automated trend-following system did not take any trades. However, the group remained disciplined while waiting until volatility and overall conditions improve.

Member Trades Spotlight

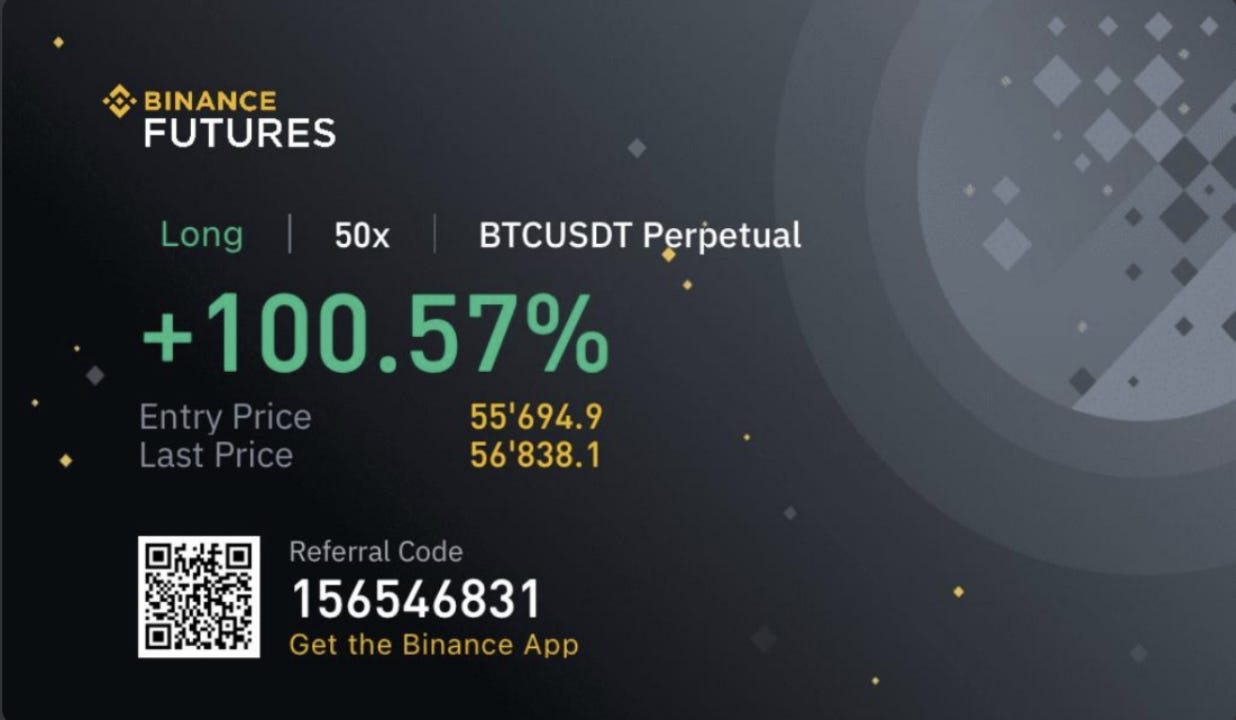

Justpit longed BTC off Monday’s higher low and caught a great win. Well done!

Lessons learned

l Don’t force trades

l No position is a position

l Respect the news cycle

Crypto Highlights

Biggest gainers this week (Top 500):

$MDX + 140.3%

$ALEX + 111.7%

$SATS + 78.8%

Biggest losers (Top 500):

$MICHI - 38%

$DADDY - 27.2%

$NPC - 22.3%

Significant news in the crypto space

Vaneck files for Solana ETF with CBOE

Trump to Speak at Bitcoin Conference in Nashville on July 27

Germany concludes their $3B selling spree on $BTC

Economic Indicator highlights

Inflation Rate (CPI) 3% vs 3.3% prior and 3.1% expected

Producer Price Index (PPI) 2.6% vs 2.4% prior and 2.3% expected

Michigan Consumer Sentiment 66.0 vs 68.2 prior and 68.5 expected

How did these indicators affect the market and our strategies?

We noted at the start of the week that economic data becomes more important as the next FOMC meeting (Jul 31) approaches. This was always a risk/opportunity heading into the week. It turns out stocks reacted well to the data but crypto did not fare so great. Could it be that crypto is bottoming out just ahead of FOMC? Very possible, especially with the first rate cut expected in September.

Upcoming Week

Fed Chair Powell speaks

Retail Sales

Housing & jobs data

What we’re watching

It’s a light week on the calendar. The main event with potential market-moving implications is indeed Powell’s speech on Monday. If all goes well we might have a relatively calm week.

Community Spotlight

This week our three new team members went hard to work on improving our community and taking us to the next level. The future of The Birb Nest looks extremely bright!

Upcoming community events

Subscribe to our YouTube channel to catch all the livestreams and market updates throughout the week.

Closing Thoughts

TLDR:

· Market sentiment reaches new lows for 2024 as Bitcoin searches for a bottom

· Germany selling pressure is gone and news headlines are starting to turn bullish

· The week ahead lacks significant economic data to sway the market one way or another

What are your thoughts about the week ahead? Share in the comments!

Join Us

· Follow TheBirbNest and Trading Tank for more updates and insights

Access our group and start trading like a pro: FREE 7-DAY TRIAL

· Subscribe to our newsletter:

That’s all for now. Have a great week!

Great updates. Let's see Trump Pump BTC and the rest of the market.